With its commission‑free trading, intuitive web and mobile apps and FCA regulation, Trading 212 has become the go‑to platform for new UK investors.

I’m a financial journalist and have used Trading 212 for more than eight years. In that time I’ve invested over £40,000 via the Invest account and Stocks and Shares ISA, earned thousands in returns and interest, and taken a few losses on CFDs.

In this review I take a close look at the UK’s most popular investment platform. I cover account types, fees, platform features, real‑world user experience, and the controversies and concerns that have emerged over the years.

Whether you’re just starting out or already have market experience, this review will give you clear, practical insights to help you decide if Trading 212 is right for you.

What is trading 212?

Trading 212 is one of the UK’s most popular online trading platforms and the most downloaded trading app on iOS and Android.

Launched in the UK in 2016, it stood out with commission‑free trading, an intuitive web and mobile interface and full FCA regulation. I first joined Hargreaves Lansdown around 2014, when brokers charged up to £11.95 per trade. If you traded often or in small amounts, those fees could quickly erode your returns. Trading 212, much like Robinhood, tore up that model.

Today you can use Trading 212 to deal in shares, ETFs, CFDs, commodities and forex. Direct cryptocurrency trading is no longer offered here – if crypto is your focus, I’d point you towards a specialist like eToro.

Throughout this review I’ll compare Trading 212 against popular platforms such as Hargreaves Lansdown (the UK’s largest platform by volume) and newer rivals such as Freetrade to show you exactly how it measures up.

Trading 212 accounts

Trading 212 offers four main live options for UK residents: Invest, Stocks and Shares ISA, Cash ISA and a practice account. You can open any combination to suit your needs.

Invest

This is a traditional trading account, with more than 10,000 securities (shares and ETF’s) available to trade. Unlike the more traditional platforms though you can start investing from as little as £1. All trades are commission free, with a small foreign-exchange fee if you buy in another currency. Returns above the capital gains tax allowance are taxable.

Stocks and Shares ISA

Works like the Invest account but all gains are tax free. There are no admin charges or commissions. You can start with £1 and deposit up to £20,000 each tax year. Uninvested cash earns 3.8% AER, often higher than many cash ISAs.

Cash ISA

Launched in 2024, this Cash ISA carries the usual ISA tax benefits and FSCS protection up to £120,000. It pays 0.15% below the BOE’s base rate on all deposits. The full terms and conditions are worth reading before you open a cash ISA.

Practice account

This is where you learn how to use Trading 212 and get to grips with buying and selling stocks. You get £50,000 in virtual funds to test trades, chart tools and order types before using real money.

For details on the CFD account, see the dedicated CFD account section below.

Open a Trading 212 Invest or Stocks and Shares ISA via our link (or promo code "MSA212"), and you'll get a free fractional share worth up to £100

For Invest and ISA accounts, eligible UK customers are also covered by the Financial Services Compensation Scheme (FSCS) up to £120,000 per person. T&Cs apply.

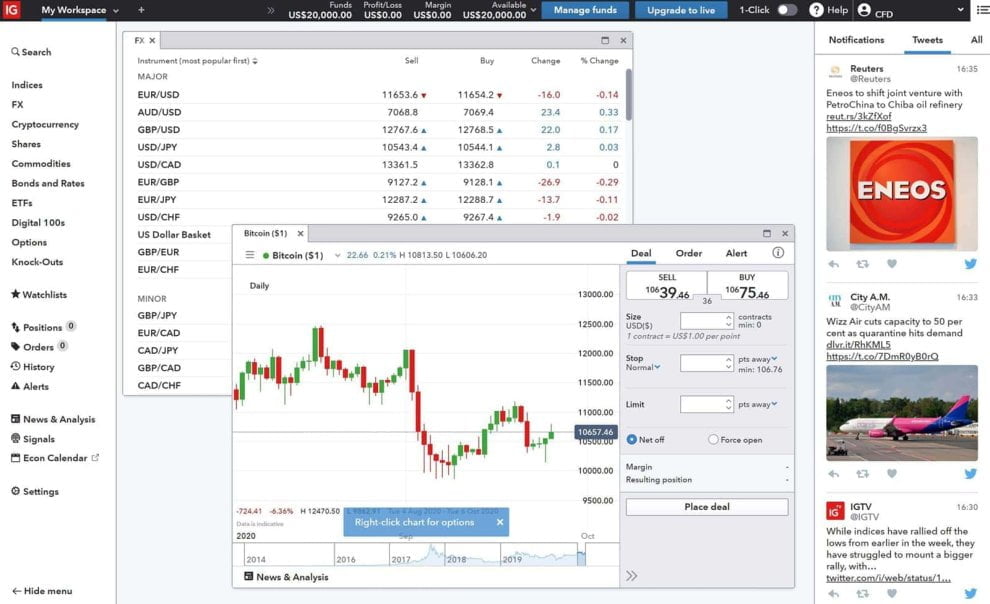

CFD account

The CFD account isn’t designed for beginners. CFDs are leveraged trades, and it’s easy to lose more than you expect if you don’t fully understand how they work.

You’re not buying the asset itself, you’re speculating on its price. If you think it’ll go up, you go long. If you think it’ll fall, you go short. Trading 212 takes the other side of the trade, and you settle the difference when you close it.

Spreads on CFDs are wider than in the Invest or ISA accounts. This is to cover volatility and reduce Trading 212’s risk. There’s also an overnight fee if you hold a position open for more than a day. You can see the full breakdown on Trading 212’s CFD pricing page.

Leverage is capped at 5:1 for equities and 20:1 for major forex pairs, in line with FCA rules. If your trade moves against you, it may be closed automatically to prevent further loss.

CFDs can be useful for short‑term trades, but they carry high risk. According to Trading 212’s own data, more than 80% of retail traders lose money using CFDs. Proceed with caution.

Trading 212 interface – great for beginners

All trading platforms have a learning curve. Some more than others, but when it comes online trading, Trading 212 is pretty much the best out there in terms of ease-of-use. In the past, I’ve used HL, Vanguard, and IG. I also have an account with Freetrade, but more on that later.

Compared to HL, IG and Vanguard, Trading 212 offers a clean, simple, easy-to-use interface. It’s what you’d expect from using modern web or mobile app. By contrast, IB’s interface (in 2023) resembles 1993’s release of Microsoft Windows 3.11.

It’s more powerful for sure, but the myriad of windows and additional screens, leaves new users completely perplexed.

One of the standout features of Trading 212 is its user-friendly interface, which makes it easy for even novice traders to buy and sell assets. The platform’s layout is clean and straightforward, and it offers several customisation options, allowing users to tailor their trading experience to their needs.

The platform also offers a range of tools and resources, including charts, news feeds, and a community forum, to help users make informed trading decisions.

Trading 212 on the other hand is straight forward and intuitive. In fact, it’s been criticised for almost being too easy, making trading seem more game-like and thus detaching users from the risks involved when trading.

I can’t comment to that personally, but after years of using HL, and getting around its clunky interface, I was relieved when Trading 212 came along. I immediately felt a home with the interface, and found all the features I was looking for without needing to keep the FAQ or help section open in another browser tab.

If there’s one criticism of the Trading 212 interface, it’s that its modern layout doesn’t lend itself well to conducting in-depth research on stocks. There’s basic data and financials but not on the scale of HL, and only on the top/most popular companies.

Trading 212 features

Trading 212 has all of the usual features you’d expect from a top trading platform. Many of these are available to some degree in other platforms, so I’ll use this section to cover the most popular, and important features, found on Trading 212.

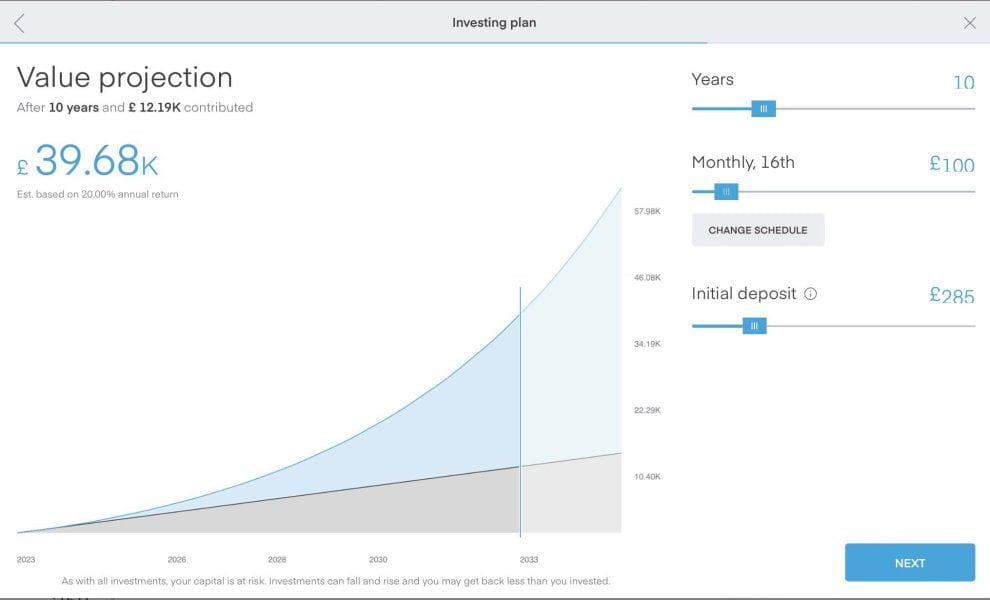

Auto invest and pies

A lot of platforms have an auto invest function, some such as HL are even free (only UK stocks, ETFs, and funds). Auto investing, or setting up regular payments to invest in stocks as part of your long term strategy is a great way to ‘dollar cost average’ (DCA) your stocks, or should I say pound cost average in this case.

Trading 212 takes auto investing to the next level with the introduction of Pies. A pie is a collection of stocks or ETFs, each represented as a slice of the pie. You can hold up to 50 stocks in a pie and have multiple pies all based around various themes, or risk levels.

Think of them as your own mini fund, helping you to diversify your portfolio without having to make complex calculations on how much money should be allocated to each security in the fund.

You initially choose the stocks you want, and the weighting of those stocks in the pie, and auto invest does the rest. Just select the deposit amount and the frequency, and funds will automatically be added to your pie based on your weighting preferences.

This is one of the stand out, and most popular features of Trading 212. There’s a whole section on the Trading 212 community boards, discussing and sharing pies. The cool thing about pies is that if you see a pie you like created by someone else, you can copy it, and add it your own portfolio, or share your pie for others to copy.

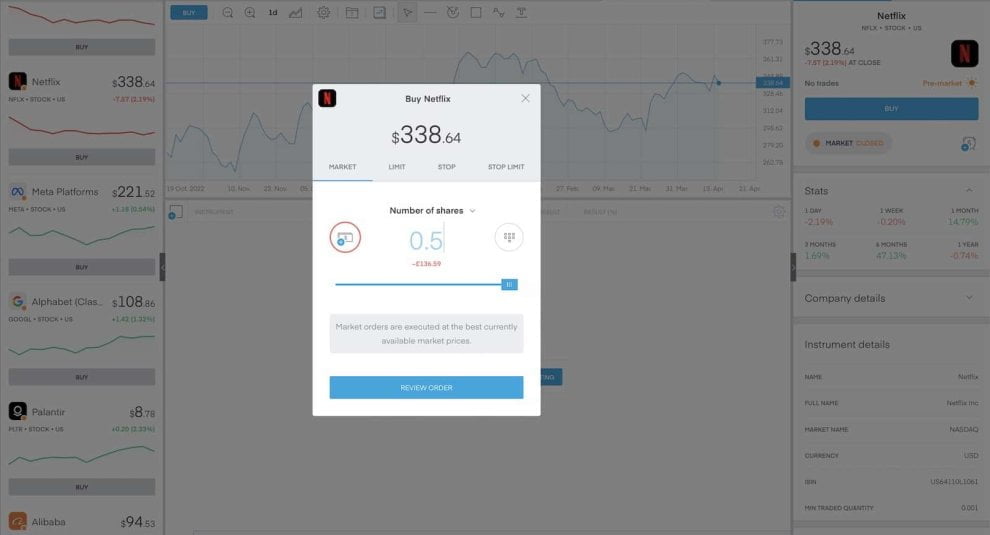

Fractional shares

In the age of the home investor, stock splits have become all the rage. Apple, Amazon, Microsoft, Nvidia, Tesla, and even Alphabet have all split their stock in recent years.

This makes it cheaper to buy a share in the company, and so easier for the general public to get a piece of the action. Amazon was trading at $2,785 a share before its 20-to-1 stock split, and was brought down to $139 afterwards.

Some companies have never had a stock split. The most famous of which is Berkshire Hathaway, where a single share would set you back $496,000. But that is where fractional shares come in. Few could afford a Berkshire Hathaway share, but with fractional shares, you wouldn’t have to buy a whole share to invest in the company. You could by a tenth of a share, or if that is too expensive (due to the extreme example used) a hundredth of a share.

Fractional shares were most popular when the likes of Tesla, Amazon, and Alphabet were trading in $2,000 plus range. These days, there aren’t many companies with stock prices that high, but fractional shares still a have use, especially when it comes investment pies mentioned above.

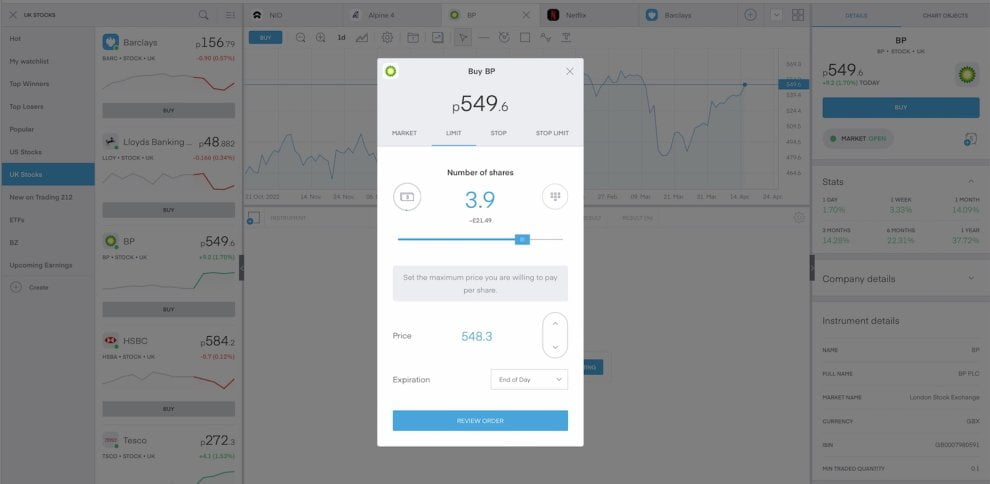

Limits, Stops, and orders

When it comes to order execution Trading 212 offers comprehensive stops and limits options. Other platforms offer these too, but the implementation in Trading 212 is probably the cleanest and easiest I’ve come across.

I won’t go into detail what a limit or a stop order is here, but briefly, such orders are used to buy or sell and assets when a price reaches a certain level. They can used to stop losses or limit the amount you are willing to pay for certain shares. They are a valuable tool in any trader’s arsenal.

The screen shot below shows a limit order on BP shares, which will buy BP shares if/when the price drops to 548.3p at some point during the current trading day.

Everything is clearly laid out, with the number of shares, limit price, and the amount it’s going to cost all adjusting automatically depending on which one you move. It also offers a short description of order as a reminder. Yes, I’ve accidentally set a stop instead of a limit order when not paying close attention before. Doh!

It’s head and shoulders above the likes of HL. Especially when it comes to US or other foreign shares, which HL insist on showing in pounds and pence rather than the original currency.

News and Calendar

Traditional platforms attract serious investors who are expected to do their research off platform, and as such know key dates and information. Trading 212, attracts trading novices, and amateur investors, and as such has a calendar sharing key dates an information.

This could be anything such as US markets being closed for Martin Luther King Day, or Nvidia earnings being due in March. It also highlights certain events in markets, such as if a particular stock has taken off, or IPO launches.

It’s no substitute for proper news though, Trading 212 has improved massively in this area, but I’d love to see it incorporate market news and info from Benzinga, or similar. US platform Webull does, and it makes a big difference to the quality of the news.

Interest on uninvested cash

It’s pretty common to keep somewhere between 5-15% of your investment portfolio in cash. That doesn’t need to be in an investment app, it could be in an easy access savings account (see our guide to the best easy access digital savings accounts).

If, like me however you do like to keep some cash on hand within your investment app, you’ll be pleased to know that Trading 212 now pays interest on uninvested cash.

At the time of writing Trading 212 pays 3.8% AER on GBP with no maximum deposit limits. The interest is paid monthly.

It’s worth pointing out though, that unlike your savings in a bank account, those in your Trading 212 account may be held in qualifying money market funds (QMMF).

These are low risk financial assets that aim to provide a stable value, and are designed as safe places to keep your cash. That being said, like any instrument there can be small though extremely unlikely risk that the QMMF goes down in value. Trading 212 does have measures in place to mitigate against this.

Those who’d prefer not to receive interest on their cash can opt out in their control panel.

Trading 212 debit card

In addition to earning interest on uninvested cash, Trading 212 now offers a debit card that you can use to access the money in your invest account.

We have a full separate review of the Trading 212 debit card here, but in short the card allows you spend money in your Trading 212 spending pot. It also offers 0.5% cashback and is some of the best exchange rates around when spending abroad.

The Trading 212 debit card is issued by Paynetics which also provides all payment services. T212 provides customer support and user interface.

Share lending

Another new feature of Trading 212 is the share lending program. This is a way to make additional returns from shares you are holding long term. You can select the shares you want to lend out, and in return you’ll receive daily interest and collateral.

Use code MSA212 to get a free fractional share worth up to £100.

One of the features that helped Trading 212 to grow as much as it has done is its ‘free fractional shares’ offer.

To boost subscribers, it offers a refer a friend scheme, where current users can invite friends (and everyone else) to join the platform, both you as the referrer, and your friend, will get a free fractional share each worth up to £100.

To get the free fractional share you or your friend need to:

- Sign up to Trading 212 using the referral link provided

- Verify your identity and pass any KYC and anti-money laundering checks

- Deposit more than £1 for Invest or ISA accounts, or more than £10 for a CFD account

As well as referral links Trading 212 regularly offers promotional codes that give users free fractional shares or bonuses when they sign up for an account.

Open a Trading 212 Invest or Stocks and Shares ISA via our link (or promo code "MSA212"), and you'll get a free fractional share worth up to £100

For Invest and ISA accounts, eligible UK customers are also covered by the Financial Services Compensation Scheme (FSCS) up to £120,000 per person. T&Cs apply.

What can you invest in?

New investors are usually encouraged to invest in funds or indices, but if you’re interested in expanding your range of investments, Trading 212 has you well covered.

Stocks and shares

Stocks and shares are the bread and butter of any online trading platform, so it’s no surprise then that Trading 212 covers over 10,000 stocks from exchanges around the world.

All of the major stock exchanges are there, FTSE100, Dow Jones, NASDAQ, etc.. plus, all major European and Asian markets.

Despite this, the range of stocks isn’t all encompassing. IB for example offers more, but it’s still a wider range than most free platforms offer, and more importantly, commission free trading isn’t just limited to the major markets as it is on some of the competition.

If there is a stock you are interested in that isn’t yet covered, you can contact Trading 212, and they will consider adding it to the platform if the demand is high enough.

This actually happened to me with pharmaceutical stock I had been trading on HL. When I switched to Trading 212, the stock wasn’t available, so I contacted them about it, and the stock was added a few days later.

Exchange traded funds (ETFs)

ETFs, or exchange traded funds, are funds which are listed on the stock exchange. Just like regular funds these can be based around a theme or industry, for example fintech, or manufacturing. They can also be based on indices, regions, or anything else.

There are tens of thousands of ETFs out there, and Trading 212 covers most of them. At least those that beginner and intermediate traders will be interested in.

That just as well, because while ETFs are available, regular mutual funds, cannot be bought via Trading 212.

Indices

If you want to trade a particular stock exchange itself, then trading 212 has you well covered here.

For example, the S&P 500 is a popular choice, representing the top 500 companies in the US, but also used to a benchmark for US stocks as a whole. Trading the S&P 500 allows you to bet for, or against the US stock market, and the economy in general.

The FTSE100, DOW, DAX40, CAC40, NASDAQ etc. are all represented.

Commodities

Commodities such as gold, silver, oil, grain, and even cattle, are also tradable in Trading 212 via a CFD account.

I’m not a commodity trader myself, beyond dabbling in gold during periods of market turmoil, but the range appears decent with over 45 markets available. Dedicated commodity dealers may which to look elsewhere though.

Foreign exchange (Forex)

Currency exchanges are also available, again via a CFD account. All of the most popular pairs are there, USD/EUR, GBP/EUR, USD/JPY, EUR/GBP etc..

It’s worth noting that cryptocurrency can’t be traded in Trading 212. It used to be available, but new UK rules banned cryptocurrencies CFDs.

How does trading 212 make money?

If Trading 212 doesn’t charge commission then how does it make its money?

I was curious about this myself when I joined back in 2016, and found myself regularly checking the spread i.e., the difference between the buy and sell price, compared to other platforms such as HL and Vanguard.

I actually found that the spreads were better or equal to many of the more established trading platforms, so Trading 212 must be making its money in a different way.

Trading 212 makes money primarily through a business model known as “payment for order flow“. This involves selling users’ buy and sell orders to third-party market makers, who execute the trades and pay Trading 212 a fee in return.

That sounds complicated, so let’s break it down. When users place an order to buy or sell a security on Trading 212, the platform sends that order to a market maker, who then executes the trade on behalf of the user.

The market maker may pay Trading 212 a fee for the right to execute the trade, as well as for access to data about user trading activity, which can help the market maker improve its own trading strategies.

Despite not charging commission, Trading 212 does charge some small fees for certain transactions (see below), but payment for order flow is a main source of income. This revenue model has been criticised by some as potentially leading to conflicts of interest.

Specifically, some critics have argued that the platform may have an incentive to sell users’ orders to market makers who offer the highest fees, rather than those who offer the best execution quality.

Trading 212 has countered these concerns by noting that it carefully vets its market maker partners and monitors their performance to ensure that users receive the best possible execution quality.

Similar criticisms were made of US trading platform Robin Hood, and were raised during a US Senate committee hearing in 2021.

Trading 212 fees

Trading 212 may be commission free, but that doesn’t mean it’s fee free. In fact, quite the opposite. Although you won’t be charged £11.95 a trade like HL, some transactions do carry a small fee.

I’ll detail these below, but bear in mind they can and do change from time to time.

Foreign exchange fee – If you are trading in stocks and other instruments in a currency different that of your account e.g., trading shares that are priced in dollars when you have a pound sterling account, you’ll be charged 0.15%

Withdrawals from your account are free, but adding money can cost you. Deposits via bank transfer are free. Add as much you want this way and you won’t be charged. Deposits via debit cards or using Apple Pay, Google Pay or similar are free up to £2,000 Over this amount there’s a 0.7% fee.

Government fees and taxes

In the UK we’re charged stamp duty when buying UK shares over £1,000. This is currently charged at 0.5%, There’s also a £1 PTM levy on UK shares for transactions over £10,000. Of course such fees aren’t unique to Trading 212.

CFD account fees

On CFDs things are a little different. Since you aren’t trading the market directly but instead betting on price movements with Trading 212 backing the other side of the bet, it increases its spread, which in effect is a stealth fee. For example, Barclay’s stock in the Invest account costs 155.98 at the time of writing. At the exact same time, the price in the CFD account was 156.07. The difference between the two is effectively a stealth fee.

In addition to the spread, CFD trades also attract higher currency conversion fees. These are set at 0.50% vs. 0.15% for the Invest and ISA accounts.

Overall though the fees are still much lower than any traditional platform in the UK, and compare well, if not better than its peers.

Is Trading 212 safe?

Yes. Trading 212 is authorised and regulated by the UK’s Financial Conduct Authority (FCA), reference number 609146. All client cash is held in segregated accounts with top-tier banks, and Trading 212 must keep its own funds separate from client funds.

Retail CFD clients benefit from automatic negative-balance protection, so you can never lose more than your deposited amount. For Invest and ISA accounts, eligible UK clients are also covered by the Financial Services Compensation Scheme (FSCS) up to £85,000 per person.

Data security is standard industry-grade: all connections use 256-bit SSL encryption, and you can enable two-factor authentication on your account.

Taken together, these safeguards mean Trading 212 meets the same “safe-broker” criteria as established platforms such as Hargreaves Lansdown and IG.

Trading 212 issues and controversies

There have been some issues and controversies with Trading 212 in the past. One of the most notable issues was the platform’s decision to temporarily suspend trading in certain stocks in January 2021, following a surge in trading activity related to the GameStop and AMC stock frenzy.

This decision was controversial, and some users criticised Trading 212 for limiting their ability to trade, which resulted in losses for some customers. US platforms that did similar were hauled before a senate committee to explain its actions. No such action was taken against Trading 212 in the UK.

There have also been some reports of delays in withdrawals, although these issues appear to have been resolved in recent months. I personally haven’t had any issues here, but have found it strange that withdrawals seem to be split into random amounts. For example a £2,000 withdrawal might be deposited into my bank in three separate payments of £900, £600, and £500 respectively.

Overall, the platform has generally been well-regarded by users for its user-friendly design, wide range of investment options, and competitive fees. It is worth noting that it has made efforts to address some of the issues that have been raised by users, such as by improving customer support and reducing withdrawal times.

Customer support

Trading 212 provides customer support through multiple channels, including email (info@trading212.com), phone, and live chat. The platform also offers a comprehensive Help Centre on its website, which includes answers to frequently asked questions and detailed explanations of its features and services.

While Trading 212’s customer support is generally responsive and helpful, there have been some reports of users experiencing delays in getting their issues resolved. This is likely due in part to the fact that Trading 212 has experienced a surge in user activity, which has put a strain on its support resources.

To address these concerns, Trading 212 has taken steps to improve its customer support in recent months. For example, the platform has expanded its support team and increased its resources for responding to user queries. It has also launched a new “Priority Support” service for premium account holders, which offers faster response times and dedicated support resources.

Despite these efforts, some users have reported continued difficulty in getting their issues resolved in a timely manner. However, it is worth noting that Trading 212 has generally been responsive to user feedback and has made ongoing efforts to address concerns related to customer support and other areas of the platform.

Trading 212 Pros and cons

| Pros | Cons |

|

|

In summary – Is trading 212 worth it?

Yes! After years of trialing other platforms Trading 212 is my go to investment platform these days. It’s quick and easy to open an account, and the modern intuitive interface not only sets it apart from traditional trading platforms, but makes it easy for beginners to feel comfortable.

Speaking of beginners, the compressive help section with video tutorials is great for getting to grips with the basics of trading, while it’s practice account helps you to learn the platform, before committing to live trades. All that, before mentioning that it’s the cheapest platform around.

Of course, that doesn’t mean it will be suitable for everyone. The range of stocks and investments is good, but it’s not as comprehensive something like Interactive brokers (IB). So those looking to invest in more obscure stocks may need to use an additional platform or request said stocks to be added to Trading 212.

It’s a similar story with cryptocurrency though that is more due to UK rules and regulation rather than Trading 212 itself.

Those points aside, there’s precious little to criticise. A more compressive news and research section would be nice, but such information can be sought elsewhere. The main downside for me is that they don’t yet offer a self invested personal pension (SIPP), otherwise I’d be able to move my SIPP over and use Trading 212 near exclusively.

How this article was researched

- Used Trading 212 with real money since 2016 across ISA, Invest and CFD accounts.

- Checked current fees, FX rates and limits against Trading 212’s official documentation in December 2025.

- Compared features and costs against three alternatives (Freetrade, Vanguard, Halifax) for a typical UK investor.

- Reviewed recent user feedback from public review platforms and community forums to spot recurring issues.

- Our editorial team is paid the same regardless of which provider you choose; some links may earn us a commission at no extra cost to you.

3 comments on “Trading 212 review – is it any good?”

I tried to set up an account with Trading 212. All went well until I got to entering my date of birth which I was unable to do due to a tecnical error. Not good.

When will Trading 212 offer clients the option of investing in regular funds (eg Royal London Global Equity Divers M Acc) and Investment Trusts (eg. F&C Investment Trust FCIT). Until these are an option Trading 212 is not for me.

This morning I tried to set up an account with Trading 212 filled in username and a password. and was told to look at my email for a confirmation email, but nothing came in, I have checked scam and junk. Nothing.

This afternoon I have read your article above, on my laptop, and again tried to set up an account. And again NO CONFIRMATION HAS COME IN.