Think Wise and Revolut are too expensive? Then look no further than Atlantic Money, the groundbreaking UK-based fintech platform that aims to simplify currency conversion and foreign transfers while saving you up 99 per cent on cross-border payments.

In our relentless pursuit of money-saving solutions, Money Saving Answers willingly stepped up as the guinea pig to test this promising new money transfer app. Join us as we delve into the world of Atlantic Money and share our comprehensive findings in this in-depth Atlantic Money review.

What is Atlantic Money?

In short, it’s a challenger to challengers. Just like how Revolut and Wise came along and disrupted traditional banks by offering low cost international money transfer and currency conversion. Atlantic Money aims to do the same by offering ultra-low-cost transfers with highly transparent fees and excellent customer service.

The company was founded by US expats Neeraj Baid and Patrick Kavanagh who frequently needed to send money back home but were bewildered by fintechs still charing progress fees (i.e. those increasing as the amount transferred does).

As alumni of trading platform Robinhood, which in itself disrupted the brokerage industry, they set out to create a fairer, more transparent money transfer app.

Who is Atlantic Money for?

As a money transfer app, Atlantic Money is for anyone wanting to convert pounds or euros for sending abroad.

It’s not a travel card (in fact there is no card), and it works best with larger money transfers. With that in mind, we think it’s for great expats moving money between supported countries, typically for the purchase of property, or remote workers earning money in one country and living in another. For example, Americans and Brits taking advantage of Spain’s new ‘digital nomad visa.’

If you’re looking for a dedicated travel card, we recommend reading our article on the best cards to use abroad, or if you just want something to complement your existing account see our Currensea review.

Atlantic Money review – pros and cons

Before we really dig in, lets take a look some of the pros and cons of the service.

Pros

- Total transparency – Atlantic Money is completely transparent through the money sending process

- Interbank exchange rate with no mark up

- Low flat fee

- Easy to use app. Slick app with step by step prompts will have you sending money in minutes

Cons

- Limited currencies available – just 9 currencies

- Transfer speed – you can pay for faster transfers but it can still take a while

- Solely app based – no web interface

Send money in minutes

Sign up to Atlanic Money and you'll not only benefit from a flat rate fee, and one of the best exchange rates around, but you'll also get your first transfer totally free.

Atlantic Money fees and exchange rates

In terms of fees and exchange rates, Atlantic Money offers one of the most cost-effective exchange and transfer services we’ve come across.

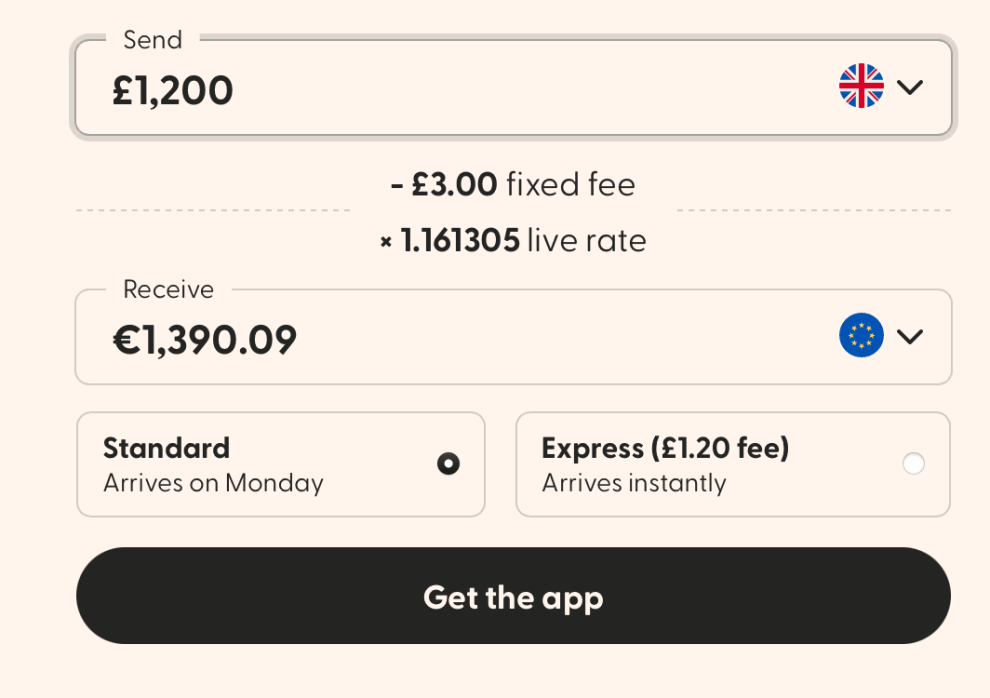

There’s no mark up on the ‘interbank’ exchange rates, and just a single fixed £3 fee per transaction regardless of how much you are sending. With an optional 0.1% fee if would like the transfer to be ‘instant’.

In our pound sterling to euro tests Atlantic Money bested Wise for amounts over £700, and Revolut for anything over £1,200. The results were similar for every currency pairing we tried.

Weekend transfers

Some multicurrency accounts and services charge an additional mark-up at for converting currency at the weekend. This is because the money markets are closed and providers don’t want to get caught out by unfavourable (to them) changes in rates.

Revolut, Starling, and even HSBC are amongst the banks and services that add this weekend mark-up. Atlantic Money doesn’t. Instead, if you make a transfer over the weekend, it will ask you if you want the exchange when the markets closed on Friday, or when they open on Monday.

Features and user experience

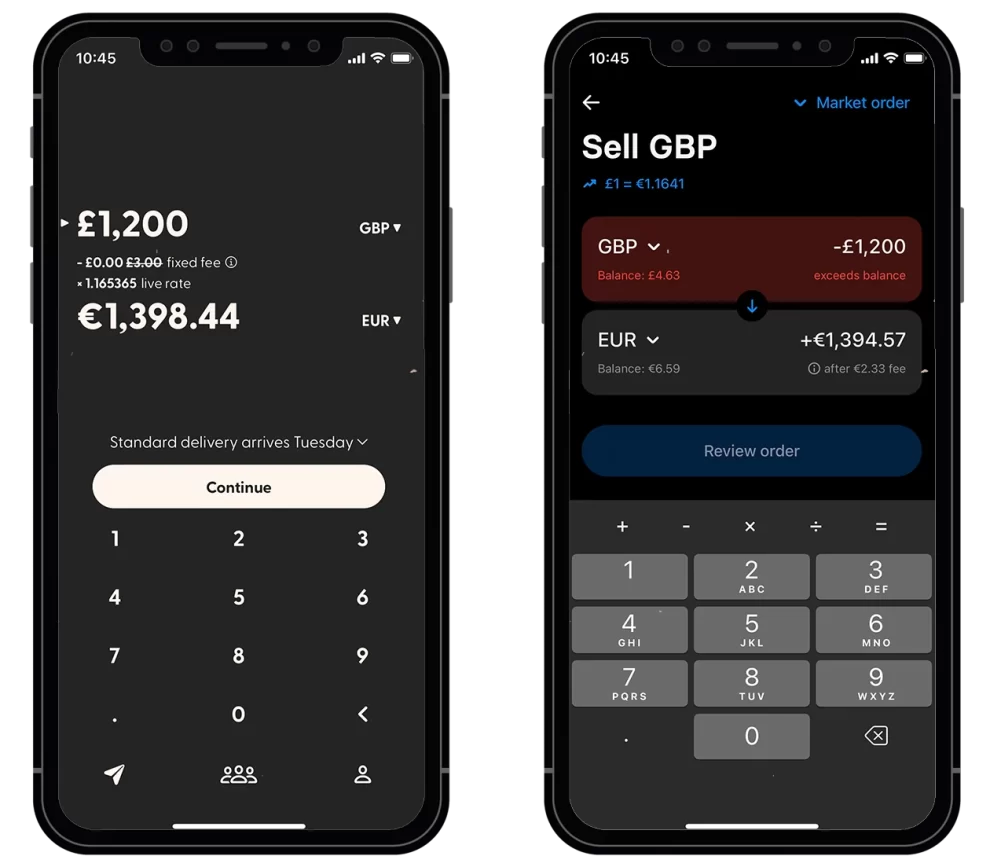

The Atlantic Money app allows customers to send money abroad in just a few clicks, making it a convenient option for those who need to transfer money quickly. It’s less cluttered than Revolut for example, and in our opinion the UI is nicer.

It provides real-time exchange rates, allowing you to make informed decisions about when to transfer your money. Ideally this would be coupled with the ability to add limit orders or notifications to allow you to exchange money once your chosen currency hits a certain price. Unfortunately, that’s not something that is offered at the moment.

When sending money, you’re prompted at each step, rather than presented with the whole form to fill out. This adds to the ‘easy to use’ feeling, but if you know what you are doing, or need to send multiple transfers then it can get a little tiring.

Currency options

At present only 9 currencies are supported, but we expect that to change in the near future. Users can request additional currencies directly from within the app and receive notification when that currencies become available in the app.

Supported currencies are:

AUD

GBP

CAD

DKK

EUR

NOK

PLN

SEK

USD

Although 9 currencies are supported, Atlantic Money isn’t a true multi-currency app. If you have a UK Atlantic Money account, you can only send/convert GBP and EUR to any of the other currencies. You can’t convert from AUD for example to GBP.

How much can I send (what are the limits?)

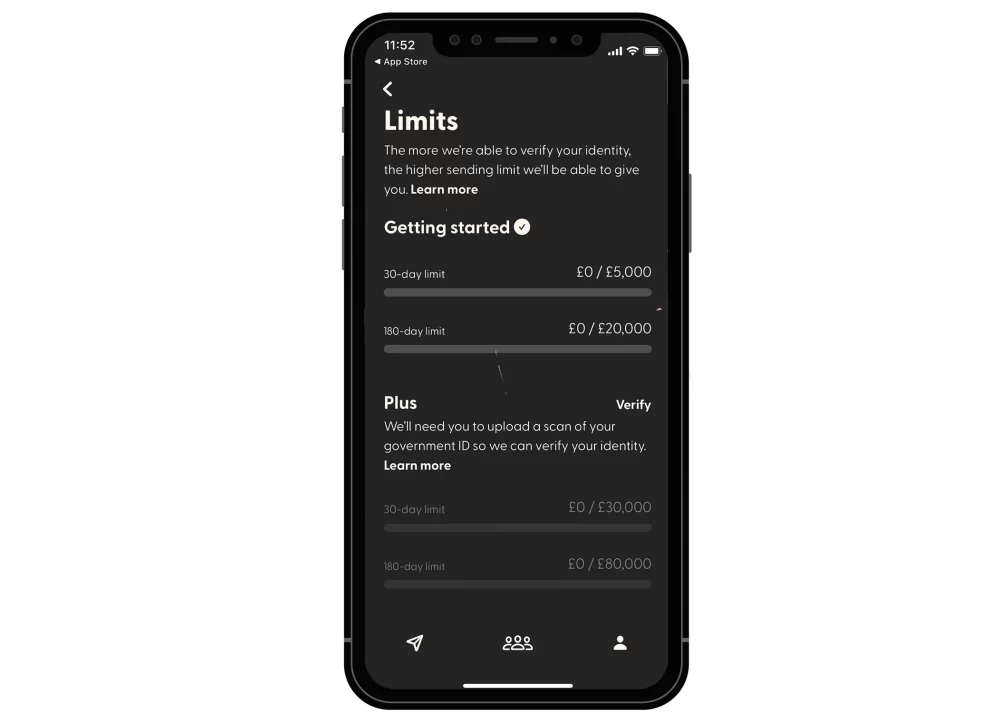

The transfer limits vary. The more Atlantic Money is able to verify your ID and where the money is coming from, the higher the limits you receive.

Our account was limited to just a few thousand on initial sign up. This jumped to £5,000 after passing some identity checks.

You can increase the limit by uploading your passport or government ID (for EU), and sending in some selfies of yourself to be matched against your ID.

This is smart way of doing things, ensures your funds aren’t held up awaiting further KYC checks as they might be with Revolut or Wise.

The maximum amount you can send is £1m, but it does vary by market/currency, and for that you need to contact Atlantic Money in the app in to complete your verification. While we have no problem trusting Atlantic Money with transfers in the thousands, or even tens of thousands, transferring a million (if we had that much) via a company would such a small balance sheet, would be a bit much.

How long do money transfers take with Atlantic Money?

Typically, it takes up to 2 business days to convert the currency, and then an additional 2 days for the actual transfer. This does vary by country and currency a little though. For instance, the transfer time for euros and GBP is instant, where as its 1 day for US and Canadian dollars.

Before carrying out your transfer you get a in app estimate of when the money will be available.

Atlantic Money vs Wise – which is cheaper?

Atlantic Money and Wise are rivals in the true sense of the word. Not only do both companies compete in the same space, but there’s actual ‘beef’ between the two.

Wise removed Atlantic Money from its popular exchange rate comparison tool earlier this year. Claiming it did so for operational issues, and queries from customers. It also refuses to list Atlantic Money on other price comparison sites it owns such as Exiap and Currencyshop.

In response, Atlantic Money developed its own comparison vs Wise, and registered a complaint with the UK’s Competition and Markets Authority.

With the politics out of the way, the short and simple answer is that Atlantic Money is cheaper for larger transfers, while Wise is cheaper for transfer below roughly £700 equivalent. The gap narrows as you reach £650, with Atlantic Money coming out cheapest for larger amounts.

Sometimes, as seen in our image above, the Wise exchange rate was slightly better, but this was eroded by fees. In other tests Atlantic Money’s exchange rate was better. Since both claim to use the mid-market or interbank exchange rate, we put this small discrepancy down the speed of updating rates in the comparison table.

One thing to bear in mind for those those needing to send money quickly, is that Wise transfers are generally faster, and there are more currency pairs to choose from. Which one is better though is all going to be down to personal circumstance. In our opinion both have their place.

Is Atlantic Money Safe?

We get it, Atlantic Money isn’t exactly a household name, so it’s only natural to ask if it’s legit.

The company is authorised and regulated by the Financial Conduct Authority (number 947491) as a payment institution in the UK and by the National Bank of Belgium in the EU.

It uses safeguarding, and operates multiple bank accounts to ensure that money held for the purposes of customer transactions is kept separately from its own funds whenever it is required to be, according to rules and regulations.

We should point out that while your funds are with Atlantic Money, they aren’t covered by the UK’s FSCS scheme. This is pretty common for money transfer companies, and is the same whether using Atlantic Money, Wise, or Revolut.

Customer Service and Reviews

Atlantic Money provides email support at support@atlantic.money as well message based support via Whatsapp and iMessage.

It has received positive reviews on Trustpilot and Monito, with customers praising its affordability and ease of use. However, some customers have reported issues with the company’s customer service, particularly when it comes to resolving disputes or addressing complaints.

Is Atlantic Money worth it? (we think so)

Overall, Atlantic Money is a great option for affordable and reliable international money transfers. The fees are up front and transparent, the app is great, and the exchange rate is amongst the best out there. That being said, it’s not without its limitations.

The flat £3 fee, means that smaller transfers are best sent via Wise or Revolut (see our long term Revolut review). Similarly, Atlantic Money isn’t best suited to be rapid transfers. You can pay for a speedier delivery, but transfers outside of GBP and EUR are still going to take a couple of days.

Furthermore, there are only 9 currencies available to exchange, so if yours isn’t listed, it’s going to be a non-starter for you. Fortunately, those that are listed are amongst the most commonly traded currencies in the UK/EU and USA.

If your transfer needs fit within these limitations, then Atlantic Money is a compelling option, and reliable way to send money abroad. It’s still early days, and the company will need to build to build trust amongst the populace if it’s going to carve out market share, but

it gets a thumbs up from us, and will be our go to transfer service in the future.

Send money in minutes

Sign up to Atlanic Money and you'll not only benefit from a flat rate fee, and one of the best exchange rates around, but you'll also get your first transfer totally free.

2 comments on “Atlantic Money review”

They also offer INR lately, can recommend!

About the wed interface – as from May 24 this feature was added to the AM interface. This is an important facet for many ppl including myself.